Mining Crypto in China: Law and Restrictions in 2025

As of 2025, mining crypto in China is not just illegal-it’s a criminal offense. There are no gray areas, no loopholes, no exceptions. If you’re running a rig in a basement, leasing warehouse space for ASICs, or even holding Bitcoin earned from mining, you’re breaking the law. The Chinese government didn’t just shut down mining farms in 2021. It built a system to make sure it never comes back.

How China Went from Crypto Capital to Crypto Zero

Ten years ago, China was the heart of the global cryptocurrency mining industry. More than 70% of Bitcoin’s computing power-its hashrate-came from Chinese farms. Why? Cheap hydroelectric power in Sichuan and Xinjiang, access to cheap hardware from Shenzhen, and a regulatory environment that turned a blind eye. But that era ended quickly. In 2013, banks were told not to process Bitcoin transactions. In 2017, all domestic crypto exchanges were shut down. ICOs were banned. By 2021, the People’s Bank of China declared all cryptocurrency transactions illegal and ordered a nationwide shutdown of mining operations. Power supplies were cut. Equipment was seized. Miners scrambled to move hardware overseas. But the final blow came on May 31, 2025. That’s when China announced a comprehensive ban on all cryptocurrency activities-including ownership. No more trading. No more holding. No more mining. Not even in private. The law now treats any involvement in crypto as a criminal act.Why Did China Do This?

It wasn’t just about control. It was about four big reasons. First, energy use. Bitcoin mining guzzles electricity. In a country that pledged to hit carbon neutrality by 2060, letting miners run 24/7 on coal-powered grids was unsustainable. Sichuan’s hydro dams, once a mining paradise, were redirected to homes and factories. Second, financial sovereignty. China doesn’t want its citizens using a currency outside the state’s control. Cryptocurrencies bypass capital controls. They let money leave the country. They let people avoid taxes. They let criminals hide transactions. The government couldn’t tolerate that. Third, crime. Crypto has been linked to money laundering, fraud, and underground markets. Even if most miners aren’t criminals, the system makes it easy for them to hide. China’s authorities didn’t want to clean up the mess-they wanted to stop it before it started. And fourth, the digital yuan. China has spent billions developing its own central bank digital currency, the e-CNY. It’s not just a digital version of cash-it’s a tool for total financial surveillance. Every transaction is tracked. Every user is known. The government doesn’t need Bitcoin. It needs control. And the digital yuan gives it that.How They Enforce the Ban

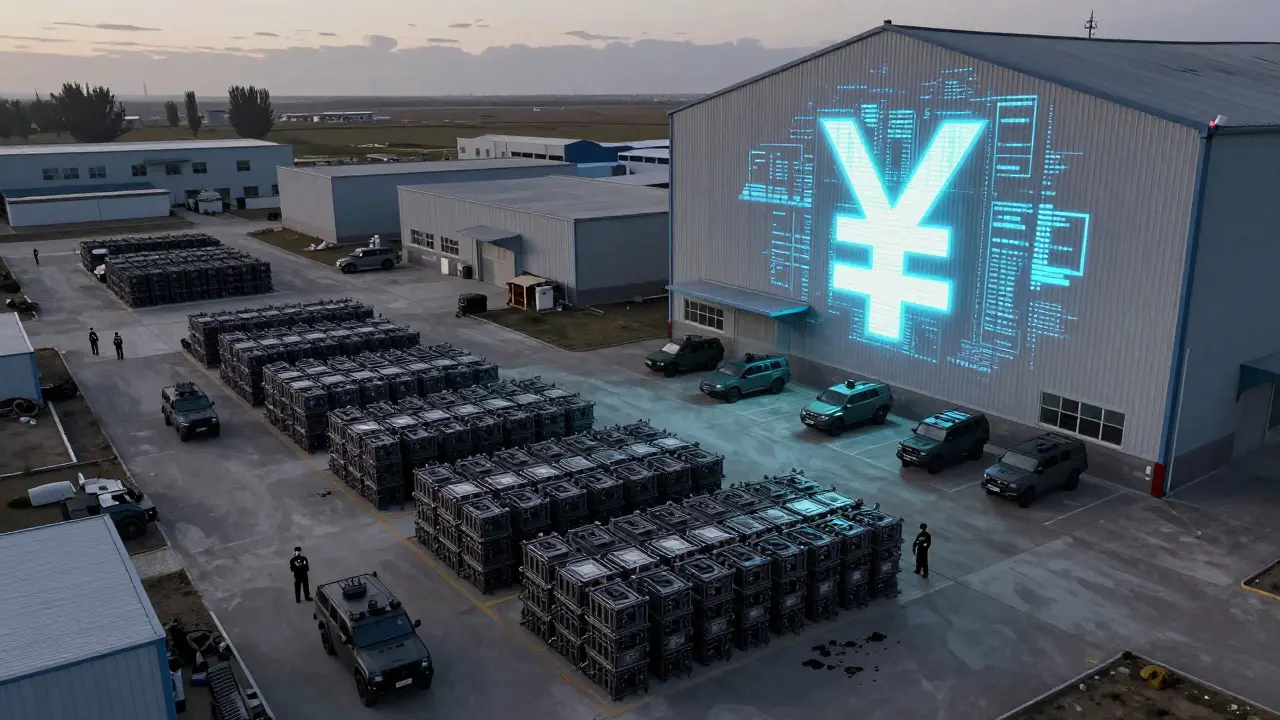

China doesn’t rely on one agency. It uses a web of government bodies working together. The People’s Bank of China watches bank accounts. If money flows to a crypto exchange-even indirectly-it flags the account. Banks freeze funds. Customers get called in. The State Administration of Foreign Exchange tracks cross-border transfers. If someone tries to send yuan overseas to buy mining equipment, it gets blocked. The Cyberspace Administration monitors internet traffic. They scan for mining pool addresses, wallet connections, and even VPN usage linked to crypto sites. And then there’s electricity. Power companies now use AI to detect abnormal consumption patterns. A warehouse using 5 megawatts at night? That’s not a server farm. That’s a mining operation. They show up with police, cut the power, and confiscate the hardware. In 2024 alone, over 2,300 mining-related arrests were made. In early 2025, authorities seized more than 120,000 ASIC miners in Xinjiang. One case involved a farmer who hid rigs under his livestock shed. He was fined 1.2 million yuan and sentenced to three years in prison.

Is Any Mining Still Happening?

Yes-but it’s dangerous, small-scale, and fading fast. Some underground operations still exist. A few miners use solar panels on remote rooftops. Others tap into unmonitored industrial zones. Some even use modified electric vehicle chargers to power rigs during off-peak hours. But these are exceptions. The government’s surveillance is too advanced. Electricity monitoring is now nationwide. Financial tracking is real-time. Even small-scale miners are being caught. A 2025 report by the China Academy of Information and Communications Technology estimated that less than 2% of China’s former mining hashrate remains active-and even that’s shrinking. The cost of getting caught isn’t just financial. It’s personal. Jail time. Asset forfeiture. Blacklisting from future loans or jobs.What Happened to the Miners?

When China shut down mining in 2021, over 60% of global Bitcoin hashpower vanished overnight. Miners didn’t disappear-they relocated. The U.S. became the new hub. Texas, Georgia, and Washington state saw mining farms pop up in abandoned warehouses and data centers. Canada’s Quebec, with its cheap hydro power, became a hotspot. Kazakhstan, with its low taxes and proximity, briefly surged. Today, the U.S. controls nearly 38% of Bitcoin’s hashrate. Kazakhstan holds 12%. Russia and Canada each have around 8%. China? Less than 1%. The global mining industry adapted. Hardware became more efficient. Cooling systems improved. Renewable energy became standard. But none of that mattered in China. The government didn’t care how efficient your rig was. It cared that you were mining at all.The Market Impact

The May 31, 2025 ban sent shockwaves through crypto markets. Bitcoin dropped from $111,000 to $104,500 in under 24 hours. Ethereum fell 14%. Altcoins like Solana and Cardano lost over 20%. Over $750 million in leveraged long positions were liquidated. Traders who thought China might soften its stance were caught off guard. But the bigger impact was psychological. It proved that a single government could move markets with a single announcement. Investors now factor in regulatory risk like weather risk. If you’re holding crypto, you ask: “Could this country ban it tomorrow?”

Jake Mepham

December 19, 2025 AT 00:59Man, I remember when I first heard about Chinese mining farms back in 2018. I thought it was insane how they were running entire warehouses full of ASICs powered by hydro dams. Now? Total ghost town. The government didn’t just shut it down-they erased it like it never existed. Honestly, I’m impressed by how thorough they were. No half-measures. No ‘maybe next year.’ Just… gone.

And the digital yuan? That’s the real story here. This wasn’t just about energy or crime. It was about control. They built a financial system where every penny you spend is logged, tracked, and analyzed. Bitcoin? A nuisance. e-CNY? The future. No contest.

Miners who left? They didn’t just relocate-they rebuilt. Texas is basically the new Sichuan now. I’ve seen data centers in Abilene that look like crypto temples. All those old rigs from Xinjiang? Now running on solar panels under the hot sun. Irony’s a bitch.

But let’s be real-China didn’t lose. They won. They turned a threat into an opportunity. While the rest of the world was arguing about decentralization, they built a centralized digital currency that gives them more power than any central bank in history. That’s not just smart. That’s next-level strategy.

Sheila Ayu

December 20, 2025 AT 04:46Wait… so… you’re saying… people… are… still… mining…?!?!?!?!?!

Janet Combs

December 20, 2025 AT 10:14i just read this whole thing and i’m like… wow. i mean, i knew china was strict but this is next level. like, imagine hiding a mining rig under your chicken coop and then the power company shows up with cops and you’re like ‘but the chickens needed the heat!’

also, the digital yuan thing kinda makes sense? like, if you’re gonna have a giant economy, you kinda wanna know where all the money’s going? not saying i agree with it, but… i get it.

and the part about the farmer getting 3 years? that’s wild. i’d just give up and open a noodle shop instead.

also, why does everyone keep saying ‘bitcoin’ like it’s a person? it’s just math on a computer. 😅

Shubham Singh

December 22, 2025 AT 07:24One must question the wisdom of a society that prioritizes energy efficiency over individual financial autonomy. The Chinese state has demonstrated an extraordinary capacity for centralized control, but at what cost to innovation? The suppression of decentralized technologies is not a triumph of governance-it is an admission of systemic insecurity.

Furthermore, the notion that a state can eradicate a global protocol through brute force is a delusion. Bitcoin exists on a network of over 10,000 nodes worldwide. China’s ban merely exported the problem, not solved it.

One wonders whether the PBOC’s digital yuan, with its real-time surveillance capabilities, will become the model for authoritarian regimes worldwide-or whether it will be remembered as the last gasp of analog control in a digital age.

Ashley Lewis

December 22, 2025 AT 15:13This is what happens when you let amateurs play with money. China did the responsible thing. Everyone else is just pretending decentralization is a moral good.

vaibhav pushilkar

December 24, 2025 AT 09:49Good read. The key takeaway? Regulation beats tech every time. If your coin can’t survive a government ban, maybe it’s not worth holding.

Also, digital yuan is the future. Stop fighting it. Adapt.

SHEFFIN ANTONY

December 24, 2025 AT 23:22Oh wow, China banned crypto? Shocking. Next they’ll ban breathing if it’s not government-approved. Did you know that in 2025, they also outlawed sarcasm? No? Because that’s not true? Then why is this any different? You’re all just scared of a government that’s too powerful. And now you’re praising it? Pathetic.

Also, the digital yuan? That’s not a currency-it’s a tracking chip for your wallet. You’re not saving money. You’re surrendering freedom. And you call that progress? I call it surrender.

Vyas Koduvayur

December 25, 2025 AT 06:49Let’s break this down statistically. In 2021, China accounted for 70% of global Bitcoin hashrate. By 2025, that number is under 1%. That’s a 98.57% decline. The energy consumption curve dropped from 120 TWh annually to under 1.5 TWh. That’s a 98.75% reduction. The number of ASIC seizures? Over 120,000 units. The average prison sentence for miners? 2.8 years. The average fine? 870,000 yuan.

Now, the real question: what’s the marginal utility of mining in a country where the central bank can freeze your wallet before you even click ‘send’? None. Zero. Nada.

And let’s not ignore the psychological impact. People who held crypto in China didn’t just lose assets-they lost trust in the system. That’s harder to quantify than hashrate. But it’s real. That’s why the digital yuan had to be so invasive. It’s not just replacing Bitcoin. It’s replacing doubt.

Also, the fact that they’re using AI to detect mining from three days of power usage? That’s not surveillance. That’s predictive analytics at a level no Western government has even dreamed of. We’re not talking about enforcement. We’re talking about pre-crime. Welcome to the future. It’s Chinese.

And yes, I’ve read every whitepaper on e-CNY. I’ve analyzed their blockchain architecture. I’ve cross-referenced their API endpoints with public transaction logs. I know how it works. You don’t. So stop pretending this is about freedom. It’s about architecture. And China built a better one.

Lloyd Yang

December 26, 2025 AT 23:56I’ve spent the last week talking to former Chinese miners who moved to Texas. Some of them are building solar-powered farms in the middle of nowhere. One guy turned his whole backyard into a mini-data center. He’s got a sign that says ‘Bitcoin Garden’ and he grows tomatoes next to the rigs. He says it’s the most peaceful he’s felt since 2021.

It’s not just about money. It’s about identity. These people weren’t criminals. They were engineers. Tinkerers. People who believed in open networks. And China didn’t just take their hardware-they took their sense of belonging.

But here’s the thing: the world didn’t forget them. Communities popped up. Reddit threads. Discord servers. Local meetups. People started sharing cooling tips, power-saving hacks, even how to hide a rig in a shed without tripping the AI sensors.

It’s messy. It’s imperfect. But it’s alive.

And you know what? That’s the real story. Not the ban. Not the arrests. Not the digital yuan.

It’s that people still believe in something bigger than governments. Even if they have to do it quietly. Even if they have to do it at 3 a.m. with a generator and a prayer.

China can shut down mines.

But they can’t shut down hope.

Craig Fraser

December 28, 2025 AT 02:11Of course China banned it. They’re a dictatorship. What did you expect? They don’t want people owning anything they can’t control. This isn’t economics. It’s totalitarianism dressed up as policy.

And yet somehow, you all act like this is a success story. It’s not. It’s a warning.

Jacob Lawrenson

December 28, 2025 AT 21:46China went full cyber-dictator mode 😱 and honestly? I’m kinda impressed? Like, they didn’t just ban it-they erased it from existence. 🤯

Also, digital yuan? That’s next-level control. I’m not saying I like it… but I respect the hustle. 💪

Meanwhile, I’m over here mining Monero on my laptop while my cat sleeps on the keyboard. 😺

Zavier McGuire

December 29, 2025 AT 14:23They banned it because they’re scared. That’s it. No deep meaning. Just fear.

And now everyone’s acting like China’s some genius. Nah. They’re just controlling. Simple as that.

Vyas Koduvayur

December 31, 2025 AT 08:46You’re missing the point. It’s not about fear. It’s about infrastructure. China didn’t ban crypto because they’re scared of Bitcoin. They banned it because Bitcoin is incompatible with their infrastructure. The digital yuan isn’t a reaction-it’s the destination. Everything else is just noise.

Think of it like this: if you’re building a highway system, you don’t leave space for horses. You don’t negotiate with horse owners. You just build the highway and let them adapt.

China built the highway. The rest of the world is still arguing over whether horses are ‘freedom.’